Deciding between an Inc (corporation) and LLC (limited liability company) is key for entrepreneurs. Each structure has its own benefits, affecting legal protection and taxes. Knowing the differences is vital for choosing the right fit for your business.

LLCs are becoming more popular, with over 5 million in the U.S. as of 2023. This is a 20% rise in five years. In contrast, corporations make up about 30% of all businesses. The trend shows LLCs are the top choice, with 70% of businesses choosing them.

Tax flexibility is a big reason for this trend. About 60% of small business owners like LLCs for their tax perks. LLCs can be taxed as a pass-through entity or a corporation, avoiding double taxation. Corporations, however, face a 21% tax rate and double taxation on profits and dividends.

Yet, corporations are still the go-to for professional investors. About 75% of venture capital goes to corporations. This is because corporations can issue stock and have a solid governance structure.

Key Takeaways

- LLCs represent 70% of registered businesses, showing growing popularity

- 60% of small business owners prefer LLCs for tax benefits

- Corporations attract 75% of venture capital funding

- LLCs offer more flexibility in management and operations

- Both structures provide limited liability protection for owners

- The choice between Inc and LLC impacts taxation, management, and growth potential

Understanding Business Entity Basics

When starting a business, picking the right legal structure is key. You have two main choices: corporations (Inc) and limited liability companies (LLC). Each has its own benefits and challenges for business owners.

What Defines a Corporation (Inc)

A corporation is a legal entity owned by shareholders. It gives strong protection from liability and can sell stock. But, corporations must follow strict rules and have a formal management team with a board of directors.

What Defines a Limited Liability Company (LLC)

An LLC mixes features of corporations and partnerships. It protects owners from liability and offers flexible management and tax choices. LLCs are run by members who can be involved in the business.

Key Differences Between Business Structures

The main differences are in ownership, taxes, and management. Here’s a quick comparison:

| Feature | Corporation | LLC |

|---|---|---|

| Ownership | Shareholders | Members |

| Taxation | Corporate tax (unless S-corp) | Pass-through taxation |

| Management | Board of Directors | Flexible (member or manager-managed) |

| Annual Meetings | Required | Not typically required |

Both offer liability protection, but LLCs are more flexible in management and sharing profits. Corporations are better for raising capital and growing quickly.

Knowing these basics helps entrepreneurs pick the right structure. They should think about taxes, ownership, and growth plans.

Inc vs LLC: Core Differences and Similarities

Entrepreneurs often face a tough choice between corporations (Inc) and limited liability companies (LLCs). Both protect personal assets, but they vary in management and taxes. Knowing these differences can help you choose wisely.

LLCs are popular among small businesses, making up about 75% of new ones. They’re liked for their simple taxes and flexible management. Corporations, however, are chosen by about 20% of new businesses. They’re great for those who want to issue stock and have a clear management system.

LLCs are taxed differently than corporations. They avoid double taxation, saving owners 15-20% in taxes. But, LLC owners must pay self-employment taxes, which are 15.3% for Social Security and Medicare.

| Feature | LLC | Corporation |

|---|---|---|

| Management Flexibility | High (60% cite as key reason) | Structured (70% have board of directors) |

| Regulatory Requirements | Fewer (40% less compliance burden) | More stringent (annual meetings required) |

| Formation Costs | Lower (up to 50% less than corporations) | Higher |

LLCs offer better protection and lower costs for starting and running a business. They can be up to 50% cheaper than corporations. But, corporations are better at attracting investors, with only 30% of LLCs facing challenges in this area.

“The choice between LLC and corporation often comes down to balancing management flexibility with growth potential.”

Understanding these differences will help you pick the best business structure for your goals and needs.

Formation Process and Requirements

Choosing the right business structure is key for small businesses. The setup and management of corporations and LLCs differ. This affects how you start and run your business.

Corporation Formation Steps

Starting a corporation takes several steps. You must file articles of incorporation and appoint directors. You also need to create bylaws.

This process is more complex than setting up an LLC. Corporations must hold annual shareholder meetings. They also have to follow strict legal rules.

LLC Formation Procedures

Starting an LLC is simpler and quicker. You need to file articles of organization and make an operating agreement. This can take 24 to 48 hours online or 2 to 14 days by mail.

LLCs have fewer ongoing rules. They don’t need to hold annual meetings or keep minutes.

State-Specific Requirements

Business structures vary by state. Some states offer special options like Series LLCs. These are available in Delaware, Illinois, Iowa, Nevada, Oklahoma, Puerto Rico, Tennessee, Texas, and Utah.

State fees for forming an LLC start at $99. These fees can vary a lot.

| Feature | Corporation | LLC |

|---|---|---|

| Formation Complexity | High | Low |

| Annual Meetings | Required | Not Required |

| Ownership Flexibility | Limited | Unlimited |

It’s important to understand these formation processes. This helps you make a smart choice for your business. Think about your goals and the rules in your state when deciding between a corporation or LLC.

Liability Protection Comparison

Both LLCs and corporations protect owners from business debts and legal issues. This is a big reason why entrepreneurs choose them. In fact, 70% of small business owners pick LLCs for their flexibility and protection.

LLCs let members keep their personal and business assets separate. This is why 60% of startups choose LLCs for their tax benefits. Corporations also protect shareholders but face double taxation on profits.

While both offer protection, there are differences. LLC members pay self-employment taxes, which can be up to 15.3% of their income. Corporations need more paperwork and hold annual meetings, costing about 15% more than LLCs.

| Aspect | LLC | Corporation |

|---|---|---|

| Personal Asset Protection | Yes | Yes |

| Owner Designation | Members | Shareholders |

| Tax Flexibility | High | Limited |

| Self-Employment Taxes | Yes | No |

| Administrative Burden | Lower | Higher |

Entrepreneurs need to think carefully about these points when deciding between LLCs and corporations. Both offer protection, but your business’s needs will guide your choice. This will help you achieve your goals and manage risks.

Tax Implications and Benefits

Choosing the right business structure is key for small businesses. Both corporations and LLCs have their own tax benefits and challenges. These can greatly affect your business’s profits.

Corporate Tax Structure

C corporations face double taxation. They pay taxes on profits and shareholders on dividends. This can lead to a higher tax burden. S corporations, however, offer a better tax deal. They pass profits to shareholders, avoiding corporate taxes.

LLC Tax Flexibility

LLCs enjoy pass-through taxation. This means members report income on their personal tax returns, avoiding double taxation. Single-member LLCs are taxed like sole proprietorships. Multi-member LLCs are taxed as partnerships.

Pass-Through Taxation Benefits

Pass-through taxation has many benefits:

- Avoids double taxation

- Simplifies tax reporting

- Allows for direct use of business losses to offset other income

- Provides potential for Qualified Business Income (QBI) deduction

| Tax Aspect | C Corporation | S Corporation | LLC |

|---|---|---|---|

| Entity-Level Tax | Yes | No | No |

| Pass-Through Taxation | No | Yes | Yes |

| Self-Employment Tax | N/A | On reasonable salary | On all profits |

| QBI Deduction Eligible | No | Yes | Yes |

Remember, tax implications differ between structures. Always consult a tax expert. They can help choose the best structure for your business goals and finances.

Management Structure and Flexibility

When picking a business structure, knowing about ownership and management is key. Corporations and LLCs have different ways of making decisions and running things.

Corporate Governance Requirements

Corporations have a strict hierarchy. Shareholders own the company and choose a board of directors. The board makes big decisions and picks officers for daily tasks.

This setup means regular meetings and keeping detailed records.

LLC Management Options

LLCs are more flexible in how they’re managed. They can be run by all members or by a few chosen managers. This lets LLCs change to fit different business needs.

| Feature | Corporation | LLC |

|---|---|---|

| Owner Title | Shareholders | Members |

| Management Structure | Board of Directors, Officers | Member-managed or Manager-managed |

| Decision Making | Hierarchical | Flexible |

| Meeting Requirements | Annual shareholder meetings | No mandatory meetings |

Choosing between these structures affects how decisions are made and how things run. Corporations have a clear chain of command but need more formal steps. LLCs offer more flexibility, fitting businesses that want less structure.

Think about your long-term goals and management style when picking a structure. Your choice will influence your company’s governance and flexibility for years.

Ownership and Transfer Rights

Business types vary in who owns them and how ownership can change hands. Corporations and LLCs, two common business forms, handle ownership differently.

Corporations use stocks to show who owns them. Shareholders can sell their stocks easily, without needing others to agree. This makes corporations good for getting money from investors.

LLCs, however, use membership interests to show ownership. Changing who owns these interests can be harder because others might need to agree. This can help keep the business stable but might slow down growth.

- Corporations can have different kinds of stock, giving more freedom in who owns the business.

- LLCs can set up special rules for who owns the business through agreements.

- When corporations sell stock, the people who own it might make money from it.

- LLC members might face rules on who can own the business.

| Aspect | Corporation | LLC |

|---|---|---|

| Ownership Representation | Stocks | Membership Interests |

| Transfer Ease | High | Low to Moderate |

| Investor Appeal | High | Moderate |

| Ownership Control | Less restrictive | More restrictive |

It’s important to know these differences when picking a business type. Your choice should match your business goals, like who you want to own it and how it will grow.

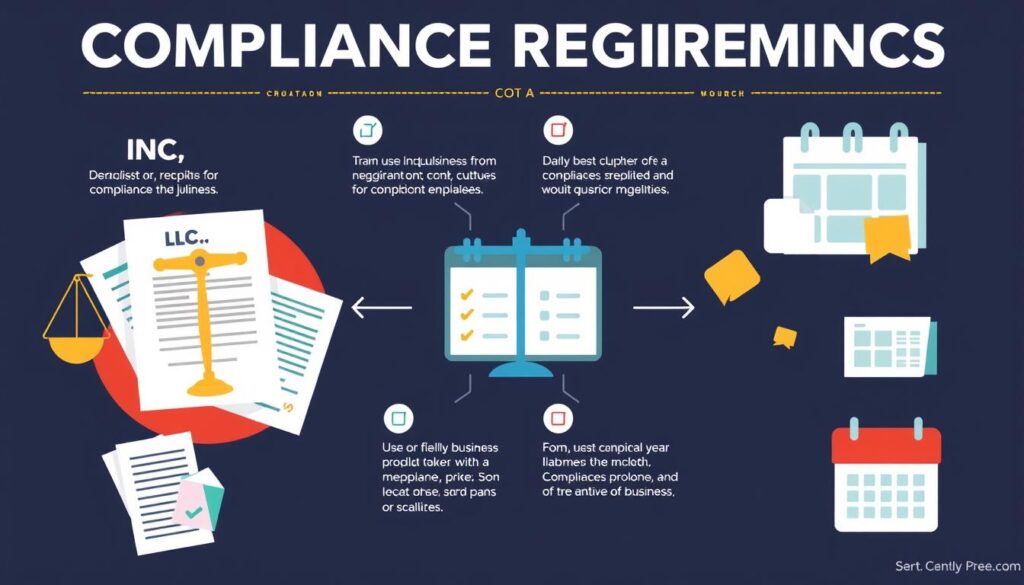

Compliance and Reporting Requirements

Legal entities must follow certain rules to stay in good standing. Corporations and LLCs have different obligations. It’s important to know these rules.

Corporate Compliance Obligations

Corporations face stricter rules. They must hold annual shareholder meetings and keep records of these meetings. Boards of directors oversee the business, creating a formal setup.

Corporations also have to file annual reports and pay franchise taxes in many states.

LLC Annual Requirements

LLCs have fewer record-keeping needs. Many states don’t require annual meetings or minutes for LLCs. They must file annual reports and pay taxes, but it’s simpler than for corporations.

LLCs offer more flexibility in management. Members can handle business affairs directly.

Record Keeping Standards

Both entities must keep proper records, but the standards differ. Corporations need detailed records of meetings, financial transactions, and stock issuances. LLCs should keep member information, financial records, and changes to the operating agreement.

Starting January 1, 2024, the Corporate Transparency Act will require most LLCs and corporations to file beneficial ownership information reports.

| Requirement | Corporation | LLC |

|---|---|---|

| Annual Meetings | Required | Not typically required |

| Minutes | Required | Not typically required |

| Annual Reports | Required in most states | Required in most states |

| Management Structure | Formal board of directors | Flexible, member-managed or manager-managed |

Cost Considerations and Ongoing Expenses

When starting a business, the choice of structure often depends on cost. Both corporations and LLCs have initial and ongoing expenses that vary by state.

Setting up a corporation can cost between $100 and $250. Setting up an LLC can cost between $50 and $500. These prices are just for state filing fees, not including legal help. The choice of structure also affects long-term costs.

Corporations have higher ongoing costs because of strict rules. They must hold annual meetings, keep detailed records, and pay franchise taxes. LLCs have fewer rules, leading to lower costs.

| Expense Type | Corporation | LLC |

|---|---|---|

| Initial Filing Fees | $100 – $250 | $50 – $500 |

| Annual Reports | Required | Often Required |

| Franchise Taxes | Common | Less Common |

| Record Keeping | Extensive | Minimal |

Corporations might cost more, but they offer benefits like unlimited shareholders and tax breaks for employee benefits. LLCs are a cost-effective choice for startups, with pass-through taxes and fewer rules.

Investment and Funding Opportunities

Choosing the right business structure is key to understanding investment and funding options. Both corporations and LLCs have their own strengths in attracting capital. However, they approach this differently.

Stock Issuance Capabilities

Corporations stand out when it comes to stock issuance. They can offer various types of stock, drawing in venture capitalists and big investors. This flexibility is why about 70% of venture capitalists prefer corporations over LLCs.

Attracting Investors

LLCs, on the other hand, face hurdles in attracting some investors. Venture capital funds often shy away from investing in LLCs due to tax issues. This can limit an LLC’s ability to get big funding rounds.

Capital Raising Options

Corporations have traditional ways to raise capital. But LLCs offer a flexible ownership structure. This can attract investors who value flexibility. Yet, it requires a detailed operating agreement, which can be hard to manage with many members.

| Feature | Corporation | LLC |

|---|---|---|

| Stock Issuance | Multiple classes allowed | Not applicable |

| Investor Preference | Preferred by VCs (70%) | Less preferred for institutional investment |

| Profit Allocation | Fixed percentage | Flexible, based on agreement |

| Complexity | Established structure | Can require complex operating agreement |

The choice between a corporation and an LLC greatly affects future funding. Corporations offer clear paths for investment. But LLCs offer flexibility that might attract some investors. Entrepreneurs need to think about their long-term goals when picking a business structure.

Growth and Scalability Potential

Choosing the right business structure is key for growth. LLCs and corporations have their own strengths for small businesses. Each fits different needs for growing.

LLCs are simple and flexible, making them a top choice for many. About 80% of new small businesses in the U.S. pick this option. They offer protection for personal assets and avoid double taxation, letting owners keep more money to grow.

Corporations, however, are great for getting investments. They can sell stocks to more people. This is good for businesses that want to grow fast or go public. But, only about 30% of venture capitalists invest in LLCs, which limits funding for them.

- Capital raising: Corporations have an edge with stock issuance

- Taxation: LLCs offer more flexibility and potential tax savings

- Management structure: Corporations provide a clear hierarchy for large-scale operations

- Ownership transfer: Corporations generally allow easier ownership changes

| Factor | LLC | Corporation |

|---|---|---|

| Formation Time | 1-2 weeks | 4-6 weeks |

| Double Taxation | Avoided | Possible (C Corps) |

| Investor Appeal | Limited | High |

| Management Flexibility | High | More Structured |

Choosing between an LLC and a corporation depends on your business goals. Think about your growth plans to pick the best structure for your business.

State-by-State Considerations

When picking a legal structure for your business, remember that state laws play a big role. Each state has its own rules for setting up and running a business. These rules affect how you form your company, what you need to do every year, and how you pay taxes.

Formation State Selection

Choosing the right state for your business can be a big plus. Delaware is known for being business-friendly and is home to over 66% of Fortune 500 companies. Wyoming and South Dakota have no corporate income tax, while Nevada and Washington use a different tax.

How much it costs to start a business varies by state. Arkansas, Arizona, and Colorado are cheap, with LLC formation fees under $50. But, states like Massachusetts, Tennessee, and Texas charge more, between $300-$500. Some places, like Arizona and Missouri, don’t make you file regularly, saving you time and money.

Multi-State Operations

If your business is in more than one state, you need to know the different rules. Delaware has low corporate taxes for businesses outside the state. But, other states might need you to qualify as a foreign company and have different rules to follow.

| State | Corporate Tax Rate | Notable Features |

|---|---|---|

| Delaware | 8.7% | Business-friendly laws, privacy protection |

| Wyoming | 0% | Strong asset protection, anonymous LLC ownership |

| New Jersey | 11.5% | Highest corporate tax rate in the US |

| California | 8.84% | Large market, high compliance standards |

Knowing these state-specific details is key when choosing between Inc and LLC structures. It helps you follow the rules and get the most out of your business.

Conclusion

Deciding between an inc and an llc is a big choice for any entrepreneur. Both have their own benefits and downsides. LLCs are now more popular, with over 2.3 million in the U.S. by 2022. This shows how much people like their flexibility and protection from lawsuits.

When you look at corporation vs limited liability company, think about your future plans. C-Corporations are good for big companies wanting to draw in investors. LLCs, however, can save a lot on taxes because of their pass-through tax system.

Your choice affects many things, like taxes and how you run your business. More than 75% of new business owners choose LLCs for their protection and tax flexibility. Remember, each state has its own rules for starting and running a business. Talk to lawyers and accountants to pick the best option for you.