The revenue cycle is crucial for healthcare organizations’ financial operations. It affects patient care and organizational sustainability. This complex process requires a deep understanding for effective management.

Revenue Cycle Management (RCM) goes beyond billing and collections. It starts when patients schedule appointments and ends with final payments. Healthcare providers need to grasp this cycle for financial health.

Healthcare providers face claim denial rates of 5% to 25%. This puts a significant amount of potential revenue at risk. Optimizing your revenue cycle can reduce denials and boost your bottom line.

Streamlined RCM processes improve financial stability for healthcare providers. They also enhance resource allocation, leading to better overall performance.

This guide explores key components of the revenue cycle. We’ll cover pre-service financial clearance to payment posting. We’ll also examine how technology is transforming RCM.

Automation in RCM leads to significant time and cost savings. It streamlines administrative tasks, allowing staff to focus on more important duties.

Key Takeaways

- RCM is a comprehensive process covering the entire patient care journey

- Efficient RCM can significantly reduce claim denials and improve cash flow

- Technology integration is crucial for streamlining RCM processes

- Patient satisfaction is linked to accurate billing and easy payment options

- Regular monitoring of KPIs is essential for optimizing revenue cycle performance

Introduction to Healthcare Revenue Cycle

The healthcare revenue cycle is crucial for medical billing and financial operations. It tracks patient care from start to finish. This process ensures proper reimbursement optimization in healthcare organizations.

Defining Revenue Cycle Management

Revenue Cycle Management (RCM) integrates administrative and clinical functions in healthcare finance. It aims to efficiently capture, manage, and collect patient service revenue. RCM includes patient registration, insurance verification, and claims submission.

Evolution of Healthcare Financial Management

Healthcare financial management has changed significantly over time. Traditional revenue collection has become an integrated approach. Front-line providers now play a key role in managing the revenue cycle.

This shift highlights the growing importance of comprehensive RCM in modern healthcare. It reflects the need for efficient financial processes in today’s healthcare settings.

Impact on Healthcare Organizations

Effective RCM greatly benefits healthcare organizations. It improves financial stability and operational efficiency. This allows staff to focus more on patient care.

- Reduced billing errors and delayed payments

- Improved negotiation capabilities with payers

- Enhanced cash flow and revenue capture

- Decreased administrative costs in billing and denial processing

“A well-functioning documentation system linked with revenue collection processes allows staff to focus more on patient care outcomes rather than billing tasks.”

Mastering RCM is essential for healthcare organizations. It helps them thrive in a complex financial landscape. As healthcare evolves, effective RCM becomes increasingly important.

Revenue Cycle Components and Stages

The healthcare revenue cycle has several key stages. Each stage ensures providers receive proper compensation for their services. Let’s explore the main components of this cycle.

Pre-Service Financial Clearance

This stage verifies patient insurance and obtains necessary authorizations. It’s crucial for preventing claim denials later on. About 30% of denied claims stem from eligibility issues.

Point of Service Collections

Collecting payments at service time is vital for cash flow. Effective patient communication can reduce bad debt write-offs by 20-30%. This stage also includes accurate charge capture and coding.

Claims Processing and Submission

Efficient claims processing leads to quick reimbursement. Automated claim scrubbing tools can reduce denials from data entry errors. This stage involves preparing and submitting claims to insurance companies.

Payment Posting and Reconciliation

The final stage records payments from insurance companies and patients. It tracks revenue and identifies discrepancies. Effective management of patient accounts can improve financial performance.

Optimizing these stages enhances revenue cycle management. The RCM market is projected to exceed $238 billion by 2030. This highlights its growing importance in the healthcare industry.

Patient Registration and Pre-Authorization Process

Patient registration starts the revenue cycle. It’s key for identifying clients and setting up correct billing. Studies show 30% of patients give incomplete info during registration.

Pre-authorization is just as crucial. It checks insurance eligibility and gets approval before care. About 15% of patients face issues due to wrong insurance details.

Both steps are vital for reducing claim rejections and avoiding surprise bills. Efficient registration and pre-authorization can boost revenue cycle performance.

- Faster payments: Accurate registration info can speed up the billing process

- Fewer denials: Proper pre-authorization can cut claim denials by 20%

- Better patient experience: Clear explanations during registration can improve satisfaction scores by 15%

Healthcare providers can use digital tools to improve these processes. These tools ensure accuracy and security in patient accounts.

By focusing on these initial stages, medical billing becomes smoother. It also becomes more efficient, leading to better financial outcomes.

“Effective patient registration and pre-authorization are the foundation of a strong revenue cycle. They set the stage for successful medical billing and improved financial outcomes.”

Insurance Verification and Eligibility

Insurance verification is vital in healthcare revenue cycles. It helps prevent claim denials and reduces revenue loss. Accurate checks can cut denials by 5% to 20%.

Benefits Verification Workflow

A strong benefits verification workflow boosts reimbursement. Timely eligibility checks can improve cash flow by up to 35%. This process is key to financial health.

The workflow includes collecting patient insurance info and verifying coverage. It also involves confirming policy details and documenting findings for billing.

- Collecting patient insurance information

- Verifying coverage with the insurance provider

- Confirming policy details and benefits

- Documenting findings for billing purposes

Prior Authorization Requirements

Understanding prior authorization is crucial for claims management. About 25% of claim denials result from failed preauthorizations. Avoiding this issue is essential.

- Check if services require prior authorization

- Submit necessary documentation promptly

- Follow up on authorization status

- Keep detailed records of all communications

Coverage Validation Steps

Thorough coverage validation can cut admin costs by 40%. A streamlined approach helps achieve this goal.

- Verify patient demographics

- Check policy status and effective dates

- Confirm covered services and limitations

- Determine patient financial responsibility

- Document all findings in the patient’s record

| Verification Method | Efficiency Increase | Impact on Revenue Cycle |

|---|---|---|

| Manual Phone Calls | 10% | Moderate improvement in accuracy |

| Online Portals | 30% | Faster verification, reduced wait times |

| Automated Systems | 50% | Significant reduction in errors and delays |

These strategies can greatly improve insurance verification processes. Better claims management and reduced revenue leakage are the results. Healthcare providers can benefit from implementing these approaches.

Medical Coding and Documentation

Medical coding is vital for healthcare revenue cycles. It turns diagnoses, procedures, and equipment into universal codes. Accurate coding ensures proper charge capture and maintains revenue integrity.

Coders use systems like ICD-10 and CPT for coding compliance. Their work affects reimbursement rates and claim approvals. About 15% of all claims face rejection.

Accurate documentation is key to successful coding. It can boost revenues by reducing denials and improving reimbursements. The current coding accuracy standard is 95%.

“Comprehensive and compliant documentation is essential to prevent unnecessary claim denials, ultimately supporting a smoother claims process.”

To improve coding accuracy, healthcare facilities can:

- Provide ongoing education for coding staff

- Implement coding automation software

- Conduct annual coding process audits

- Use practice management software for streamlined operations

Good coding and documentation lead to clean claims and timely reimbursements. Accurate HCPCS coding for surgeries can improve scheduling and reduce denials.

Revenue cycle management depends on precise coding practices. Focusing on compliance and accuracy protects revenue integrity and improves financial health.

| Coding Challenge | Impact on Revenue Cycle |

|---|---|

| Undercoding | Potential underpayment due to incomplete documentation |

| Missing Secondary Codes | Payment roadblocks and complicated claims management |

| Inaccurate Coding | Increased administrative burden on clinical staff |

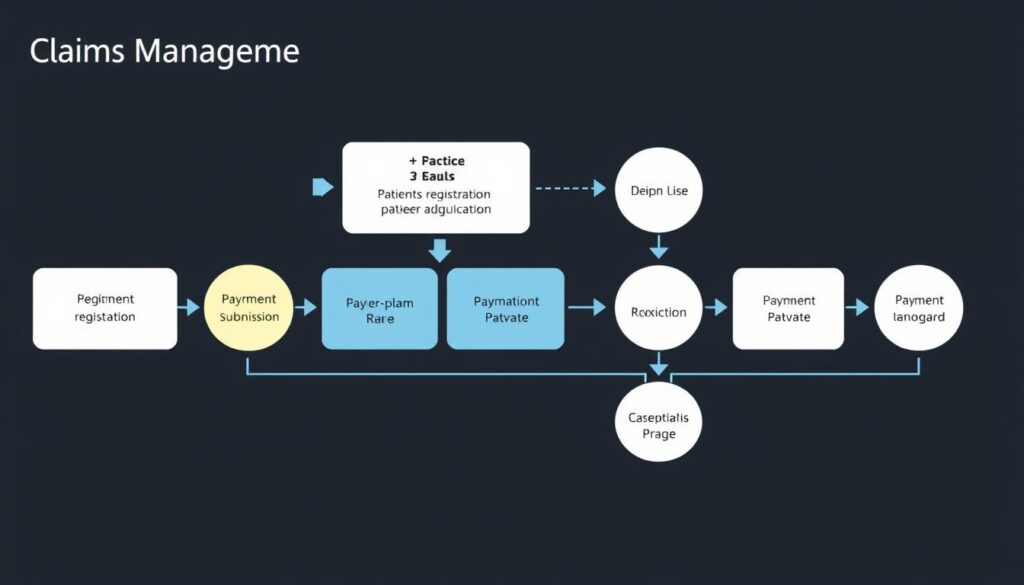

Claims Management and Submission

Claims management is vital for healthcare providers’ revenue cycles. It involves submitting coded claims to insurers for payment. Effective claims processing can greatly impact a provider’s financial health.

Clean Claims Guidelines

Submitting clean claims is key for timely reimbursement. Clean claims are error-free and contain all necessary processing information. Healthcare providers should follow specific steps to achieve this goal.

These steps include verifying patient info and insurance eligibility. They should also ensure accurate medical coding. Including all required documentation is crucial too.

- Verify patient information and insurance eligibility

- Ensure accurate medical coding

- Include all required documentation

- Adhere to payer-specific guidelines

Electronic Claims Processing

Electronic claims submission is now standard in healthcare. About 70% of medical practices use this method to streamline their process. It offers several key advantages.

- Faster processing times

- Reduced paperwork

- Lower administrative costs

- Improved accuracy

Claims Tracking Systems

Using robust claims tracking systems is crucial. They help monitor the status of submitted claims. These systems offer several benefits to healthcare providers.

- Identify and resolve claim issues promptly

- Track payment timelines

- Analyze denial patterns

- Improve overall revenue cycle performance

Focusing on these areas helps providers optimize their claims management. It reduces denials and speeds up the revenue cycle. This approach leads to better financial outcomes.

Payment Posting and Processing

Payment posting is crucial in the revenue cycle. It involves allocating payments to patient accounts after insurance companies pay. This process maintains accurate financial records and manages accounts receivable.

The Explanation of Benefits (EOB) provides key information for payment posting. It includes patient details, service dates, and procedure codes. Billers must enter EOB details into billing software for tracking.

Accurate payment posting is vital for ar optimization. It helps identify and solve recurring payment issues. Efficient posting can greatly improve cash flow for medical practices.

“Weak billing practices cost doctors approximately $125 billion annually.”

Proper payment processing ensures timely reimbursement through prompt claim processing. It provides a complete record of services, aiding financial tracking. It also helps identify revenue opportunities.

Organizations with reliable posting practices often see lower denial rates. This improvement comes from better revenue cycle management.

| Benefits of Efficient Payment Posting | Impact on Revenue Cycle |

|---|---|

| Improved cash flow | Faster reimbursement |

| Reduced claim denials | Fewer billing errors |

| Accurate financial records | Better financial tracking |

| Timely patient statements | Improved patient satisfaction |

A well-organized payment posting plan can boost organizational performance. It can also increase revenue. It’s a key part of effective revenue cycle management.

Denials Management Strategy

Effective denial management is vital for healthcare organizations to minimize revenue loss. As denial rates increase, a robust strategy becomes essential for optimizing reimbursement. This approach streamlines the revenue cycle and improves financial performance.

Common Denial Reasons

Understanding denial causes is crucial for developing an effective strategy. In 2024, 76% of denials stemmed from missing, incomplete, or inaccurate data. Common reasons include coding errors, missing documentation, and eligibility issues.

Medical necessity disputes also contribute to claim denials. Identifying these issues helps healthcare providers address them proactively.

Appeals Process

The appeals process involves steps to contest denied claims. It begins with quick identification and categorization of denials. Accurate clinical documentation is essential to capture the true clinical picture.

Healthcare providers should focus on optimizing chart quality. Collaboration between coding, billing, and clinical documentation improvement teams is vital for successful appeals.

Prevention Techniques

Preventing denials is more cost-effective than appealing them. Key prevention techniques include staff education and training on coding and documentation practices.

Implementing advanced Revenue Cycle Management platforms provides real-time insights. Using predictive analytics helps forecast potential denials.

AI-powered tools enable instant detection and correction of denied claims. Engaging in proactive payer communication and contract management also reduces denials.

These strategies help healthcare providers improve their claims management process. By reducing denials, they can minimize revenue leakage and boost financial performance.

Revenue Cycle Performance Metrics

Tracking key performance indicators (KPIs) is crucial for maintaining revenue integrity in healthcare finance. These metrics offer insights into your revenue cycle’s health. They guide efforts to improve reimbursement and financial performance.

Days in Accounts Receivable (A/R) is a vital metric. It shows how quickly you’re getting paid. The ideal range is 30-40 days, with a maximum of 50 days.

The formula for Days in A/R is:

(Total A/R / Average Daily Charges) = Days in A/R

Clean Claims Rate is another key KPI. The industry benchmark is 98%. A high rate indicates efficient claims processing.

Calculate it using:

(Number of clean claims / Total claims) * 100%

The Denial Rate is equally important. Aim for below 5%, with 5-10% being average. To improve this metric:

- Analyze common denial reasons

- Implement preventive measures

- Train staff on proper documentation

Net Collection Rate (NCR) measures your ability to collect reimbursements. The benchmark is over 95%. Calculate NCR with:

(Total payments received / Total allowed amount) * 100%

Monitor these metrics regularly to spot areas for improvement. This practice can boost your financial performance and patient satisfaction.

Technology Integration in RCM

Technology is reshaping revenue cycle management (RCM) in healthcare finance. Advanced tech integration is vital for healthcare organizations to improve their financial operations. This shift is crucial for staying competitive in the evolving healthcare landscape.

EHR Systems Role

Electronic Health Records (EHR) systems are transforming RCM. They streamline documentation and improve coding accuracy. EHRs provide real-time patient data access, reducing claim denials by up to 15%.

Automation Tools

Automation is changing claims processing and other RCM tasks. Users of RCM automation software see a 27% decrease in cost-to-collect. They also experience a 6% increase in net patient revenue.

These tools reduce manual errors and speed up processes. They boost overall efficiency in healthcare finance operations.

Analytics Platforms

Advanced analytics platforms offer deep insights into RCM processes. Organizations using data analytics for RCM see a 30% increase in revenue capture. These platforms help identify high-risk accounts and reduce claim denials.

They also improve cash flow forecasting accuracy by 20%. The global RCM market is expected to reach $282.12 billion by 2030.

Compliance and Regulatory Requirements

Compliance is crucial for maintaining revenue integrity in healthcare finance. Strict regulations require vigilance from providers to avoid costly penalties. The complex rules demand constant attention to stay compliant.

In 2023, the U.S. Justice Department recovered $2.68 billion from fraud and false claims. This highlights the importance of coding compliance in healthcare. Non-compliance can result in heavy fines and loss of licenses.

Key regulations affecting revenue cycle management include:

- HIPAA (Health Insurance Portability and Accountability Act)

- ACA (Affordable Care Act)

- Medicare and Medicaid rules

Keeping up with changing regulations is vital. Healthcare organizations must create strong compliance programs and perform regular audits. This helps prevent penalties and supports overall revenue integrity.

| Compliance Area | Impact on Revenue Cycle |

|---|---|

| Accurate Coding | Reduces claim denials and delays |

| Data Protection | Prevents costly breaches and fines |

| Billing Practices | Ensures proper reimbursement |

Advanced RCM software can improve coding accuracy and compliance. Regular staff training on new regulations is essential. Smaller healthcare facilities may benefit from consulting compliance experts for guidance.

Proactive compliance can reduce legal issues and boost efficiency. It helps streamline operations and maintain financial stability.

“Proactive revenue cycle management compliance can reduce legal repercussions and increase operational efficiency within healthcare facilities.”

Prioritizing compliance helps healthcare organizations improve their revenue cycle. It also enhances patient satisfaction and strengthens their financial foundation.

Patient Financial Experience

Patient financial experience is crucial for healthcare revenue cycles. It affects patient satisfaction and financial stability. Improving this experience is essential as patient collections grow.

Price Transparency

Clear cost communication is vital. 38% of consumers might switch providers without clear cost information. Healthcare organizations should provide upfront estimates and explain billing procedures.

This helps set proper expectations for patients. It also builds trust and transparency in healthcare services.

Payment Options

Diverse payment methods are crucial in medical billing. 85% of patients prefer electronic payment options. 29% want various choices for fulfilling their financial responsibilities.

Flexible repayment plans, credit card payments, and electronic transfers can boost patient collections. These options make it easier for patients to manage their healthcare costs.

Financial Counseling

Financial counseling helps patients understand their responsibilities. 54% of Americans earning $50,000 to $100,000 live paycheck to paycheck. Compassionate guidance is essential for these patients.

Effective financial assistance programs increase patient engagement. They also improve payment recovery rates. This benefits both patients and healthcare providers.

Healthcare providers can enhance revenue cycle management through these aspects. 56% of patients might switch providers for better payment experiences. A well-designed financial journey is key to retaining patients.

Revenue Cycle Optimization Strategies

Healthcare organizations need effective revenue cycle optimization to boost financial performance. Strategic approaches can streamline processes, reduce claim denials, and speed up collections. These improvements enhance operational efficiency and patient care.

Data analytics significantly improve revenue cycle management. Organizations using analytics see a 10-15% increase in clean claim rates. They also experience a 20-30% reduction in denials. This shows the power of data-driven decisions in optimizing reimbursements.

Automation is crucial for accounts receivable optimization. Electronic claims submission saves medical staff valuable time. Automated appointment reminders increase patient attendance. Electronic patient registration reduces data entry errors and improves information accuracy.

Timely and accurate billing is essential to minimize cash flow gaps. 83% of physicians struggle with timely patient payments. Automated payment reminders can greatly improve cash flow. Clear billing policies help patients understand their financial responsibilities.

| Optimization Strategy | Impact |

|---|---|

| Data Analytics | 10-15% improvement in clean claim rates |

| Claims Scrubbing Software | Catches common errors like missing data |

| Electronic Claims Submission | Restores hours of staff time monthly |

| Automated Payment Reminders | Improves timeliness of patient payments |

These revenue cycle optimization strategies can significantly improve healthcare providers’ financial health. By implementing these approaches, organizations can enhance their operations and deliver better patient experiences.

Best Practices for Revenue Integrity

Revenue integrity is vital for a strong healthcare financial system. It boosts revenue capture and enhances overall financial performance. Let’s explore key practices to optimize your revenue cycle.

Charge Capture Optimization

Efficient charge capture is crucial for maintaining revenue integrity. Over 30% of items in a typical CDM are coded, leaving about 70% uncoded. This gap can lead to lost revenue.

Automated charge capture systems help healthcare providers record all billable services accurately. These systems minimize revenue leakage and improve financial outcomes.

Documentation Excellence

Precise clinical documentation is vital for accurate coding and billing. A strong CDI program can lead to higher levels of care and better quality reporting.

CDI specialists working with medical coders can enhance documentation. This addresses a primary reason for poor clinical denial management.

Staff Training Programs

Investing in staff training is essential for maintaining coding compliance and revenue integrity. Regular education on coding updates can decrease billing errors.

Only 42% of revenue integrity departments conduct internal audits and compliance checks. Cross-department collaboration can enhance accuracy in coding and billing processes.

| Revenue Integrity Practice | Potential Impact |

|---|---|

| Automated Charge Capture | Minimize revenue leakage |

| Strong CDI Program | Improve quality reporting and Case Mix Index |

| Comprehensive Staff Training | Reduce billing errors and enhance compliance |

These practices help healthcare organizations optimize their revenue cycle and ensure coding compliance. Regular audits, continuous education, and technology are key to financial success in healthcare.

Future Trends in Revenue Cycle

Healthcare finance is changing fast, reshaping revenue cycle management. Value-based care models are growing, moving away from fee-for-service approaches. This shift impacts how providers optimize reimbursements and adapt their financial processes.

Telehealth use exploded during the pandemic, creating new payer reimbursement challenges. Remote work has affected revenue cycle operations, causing staffing retention issues. Automation and AI are becoming vital to address these problems.

AI in healthcare is set to grow 50% in five years. It will improve recordkeeping, diagnostics, and outcome predictions. Automation may cut manual tasks by 30%, freeing staff for complex work.

| Trend | Impact |

|---|---|

| Value-based care adoption | Shifting reimbursement models |

| Telehealth expansion | New payer reimbursement complexities |

| AI integration | 50% growth in 5 years |

| Automation | 30% reduction in manual tasks |

Patient-centric billing is gaining importance, with 72% of patients wanting more digital payment options. This shift affects about 60% of healthcare providers. They’re moving towards personalized financial experiences.

Keeping up with these trends is key for effective revenue cycle management. It will help ensure financial success in the evolving healthcare landscape.

Conclusion

The revenue cycle is vital for healthcare financial success. The global RCM market was $49.6 billion in 2023. It’s expected to reach $84.1 billion by 2028. Managing this cycle well is crucial for financial stability.

We’ve examined key parts of the revenue cycle. These include patient registration and payment processing. Important metrics highlight the need for ongoing RCM improvement. A lower Cost to Collect and higher Collection Rate show a well-run system.

Healthcare and RCM strategies must evolve together. Technology integration is essential. Focus on patient financial experience is crucial. Compliance with regulations is necessary.

Providers should regularly review their RCM practices. They should invest in staff training. Data-driven decisions are important. These steps help navigate healthcare complexities. They improve efficiency and patient care.